NBFI support measures hinge on execution: Fitch Ratings

By ANI | Published: May 21, 2020 10:56 AM2020-05-21T10:56:01+5:302020-05-21T11:20:48+5:30

Indian non-bank financial institutions' (NBFI) funding and liquidity will continue to face pressure despite a pick-up in loan collections, according to Fitch Ratings.

NBFI support measures hinge on execution: Fitch Ratings

Indian non-bank financial institutions' (NBFI) funding and liquidity will continue to face pressure despite a pick-up in loan collections, according to Fitch Ratings.

Additional support initiatives announced by the Indian government last week could help to address some earlier policy gaps, but successful implementation will be key and India has a mixed record on this front.

"Furthermore, we expect collections for the next few months to continue to fall well short of pre-coronavirus repayment schedules even though NBFI loan receipts should improve from April's depressed levels as coronavirus-related curbs are gradually eased," it said in a report.

The government's latest measures seek to ease borrower strain and boost funding conditions for NBFIs. A fully guaranteed Rs three lakh crore loan scheme for micro, small and medium enterprises aims to encourage lenders to continue funding these more-vulnerable entities, while a modest NBFI debt guarantee plan could help smaller but creditworthy non-bank lenders.

The success of these schemes will rest on implementation details that are yet to be released as well as lowering the risk aversion among banks as they are the key intermediaries in the sector.

Pandemic-related liquidity support measures to date have had limited success in improving funding conditions for the NBFI sector. Local-currency corporate bond spreads have continued to climb despite various attempts to boost credit transmission since early March.

Local NBFI bond spreads have been more affected and remained elevated even after the recent announcements. Easing spreads along with increased issuance will be key signals of improved appetite for NBFI debt.

"We believe NBFIs will continue to face considerable risks to their asset quality and liquidity even as the economy reopens gradually. The number of new COVID-19 cases continues to rise and a significant acceleration could set the process back," said Fitch.

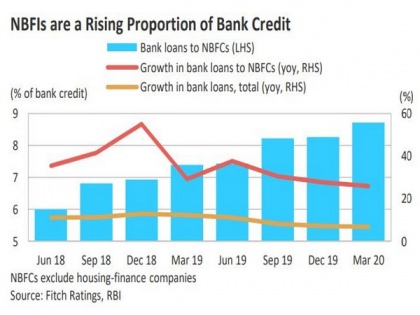

Meanwhile, banks -- the major source of incremental NBFI funding -- remain cautious in the face of looming asset quality pressure.

Fitch took negative action on NBFI portfolio in late March to reflect the sector's vulnerability to a coronavirus-related downturn. Since then, loan collections have taken a hit amid the extended economic shutdown.

Fitch-rated NBFIs have retained sufficient funding access consistent with their rating levels over the period, and recent developments are net positive for the sector.

"However, conditions remain fragile and Fitch will continue to monitor underlying developments closely as we look to address the negative watches on our Indian NBFI ratings over the coming months."

( With inputs from ANI )

Open in app