IMPORTANT! Complete these 8 important money related tasks before 30 June 2020

By Lokmat English Desk | Published: June 9, 2020 06:51 PM2020-06-09T18:51:03+5:302020-06-09T18:51:03+5:30

To provide relief against covid-induced financial stress, the govt has extended deadline, loan moratorium etc. Due to such extensions, money-related deadlines have now shifted forward from their original dates. Given below is the list of eight tasks you need to check off your money to-do list by June 30, 2020

Linking your PAN with Aadhaar

Amidst the corona virus epidemic, the central government had extended the deadline for linking PAN to Aadhaar from 31 March to 30 June. Now if you have not linked your PAN to Aadhaar by June 30, your PAN will become inactive.

Completion of tax-saving for FY 2019-20

The deadline to finish the tax-saving exercise for financial year 2019-20 has also been extended from March 31, 2020 to June 30, 2020. So if you are yet to complete your tax-savings investments, make necessary expenditures, i.e. invest under section 80C or in health insurance premiums as they are eligible for deduction under section 80D etc., you can do the same by June 30.

Filing belated/revised ITR for FY 2018-19

The deadline to file belated and/or revised income tax returns for the financial year 2018-19 also stands extended to June 30, 2020. March 31, 2020 was the original deadline, as per income tax laws.

Form-16

The government, via an ordinance dated March 31, 2020, extended the deadline for employers to issue Form-16 to their employees from June 15, 2020 to June 30, 2020 for FY 2019-20.

Depositing in small savings schemes

If you have any small savings scheme accounts such as PPF, which require minimum annual deposits/investments to be made in them, you will be penalised on not depositing such amount and your account will become inactive. Department of Post has allowed investors to make the mandatory minimum deposits in such schemes for financial year 2019-20 up to June 30, 2020, instead of the former March 31, 2020

Extending your PPF/SSY accounts

If your Public Provident Fund (PPF) and/or Sukanya Samriddhi Yojana (SSY) accounts have matured on March 31, 2020 and you were hoping to extend them but couldn't due to the lockdown, then you have time till June 30, 2020

Opening an SCSS ccount

In order to provide some relief to senior citizens between 55 years and 60 years (who have retired between February 2020 and April 2020), the government has relaxed the time limit for investing retirement benefits in the SCSS account to June 30, 2020.

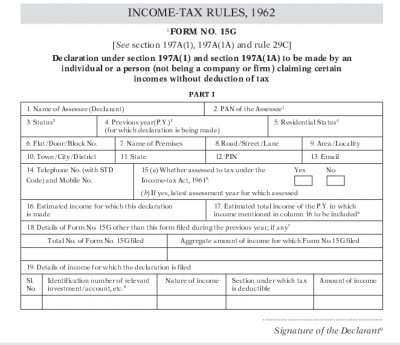

Submission of Form 15G/15H for FY20-21

The Central Board of Direct Taxes has stated that Form 15G and Form 15H submitted by taxpayers for FY 2019-20 will be valid for FY 2020-21 till June 30, 2020. This means that now investors who are required to submit Form 15G and Form 15H, they can submit it by the first week of July 2020 as well for FY 2020-21