Inflation impact on sovereigns depends on real interest rates: Fitch

By ANI | Published: June 17, 2021 05:27 PM2021-06-17T17:27:31+5:302021-06-17T17:35:07+5:30

Global inflation trends and associated risks around interest rates and exchange rates may have direct sovereign credit implications, Fitch Ratings has said adding that a critical question for government debt sustainability is how inflation will affect debt/GDP ratios.

Inflation impact on sovereigns depends on real interest rates: Fitch

Global inflation trends and associated risks around interest rates and exchange rates may have direct sovereign credit implications, Fitch Ratings has said adding that a critical question for government debt sustainability is how inflation will affect debt/GDP ratios.

Higher levels of global government debt as a result of the coronavirus pandemic have made sovereign creditworthiness increasingly sensitive to interest rate changes.

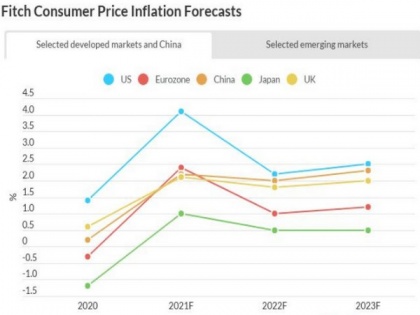

Base effects, higher commodity prices, idiosyncratic effects of sectoral re-openings and pandemic-related supply-side disruption are contributing to higher inflation in many countries.

Nevertheless, most central banks are taking the view that the rise in inflation will not last, and that now is not the right time to tighten financial conditions.

Fitch said longer-term rates matter more than policy rates for fiscal outcomes and debt sustainability, and there is no convincing evidence yet that bond markets disagree with central banks' inflation diagnosis.

Higher inflation leads to higher nominal GDP, resulting in an immediate improvement in debt/GDP ratios. This is particularly the case if -- as presently -- there is a muted response from benchmark yields to higher inflation, thus lowering governments' real marginal borrowing costs.

Even if benchmark yields rise in tandem with inflation and nominal GDP growth, it will take time for the effective (or average) cost of borrowing to catch up with the higher marginal cost, particularly for sovereigns with long average debt maturities.

All else being equal, said Fitch, these inflation conditions are positive for sovereign credit.

( With inputs from ANI )

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app