Rs 2,000 note withdrawal decision is disruption of economic system: AAP MP

By ANI | Published: May 21, 2023 08:02 PM2023-05-21T20:02:58+5:302023-05-21T20:05:08+5:30

New Delhi [India], May 21 : Reacting to Reserve Bank of India's (RBI) decision to withdraw Rs 2,000 notes ...

Rs 2,000 note withdrawal decision is disruption of economic system: AAP MP

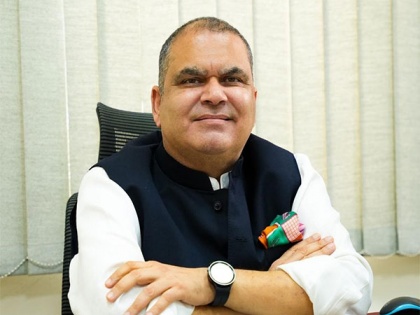

New Delhi [India], May 21 : Reacting to Reserve Bank of India's (RBI) decision to withdraw Rs 2,000 notes from circulation, Aam Aadmi Party (AAP) Rajya Sabha MP Sanjeev Arora said that this decision is a 'disruption of the economic system.'

Commenting on the withdrawal, the AAP lawmaker said, "Withdrawal of these banknotes is a disruption of the economy. Withdrawal of currency notes at regular intervals doesn't give a positive outlook of the economy in the eyes of investors and other countries."

Further, he said, "Faith in Indian currency will be shattered. The rationale behind the exchange of 10 notes is not clear. Also, most of the time, many people including housewives will have their savings in this denomination. A minimum threshold should be made for such citizens to deposit the money in their account which will not be questioned later."

Recalling the previous demonetisation period, Arora said, "Also later there was a lot of harassment issues from the part of the Income Tax authorities even if the deposit is legitimate."

He added that people are still going through the trauma from the last demonetisation and now this partial demonetisation has come up. He also appealed to the Finance Minister to rethink the issues raised by him regarding the situation.

While reacting on Tax Collection at Source (TCS), Arora said that the 20 per cent rate is too high. "TCS of 20 per cent on the amount spent is like around 70 per cent of income. If employees or professionals spend money on their personal cards which are reimbursed by employers and clients, they will have issues with how to get the TCS adjusted. Personal Credit Cards are made with personal PAN cards", he added.

Arora also alleged that this step does not encourage digital transactions.

"I feel this step is against encouraging digital transactions which the Government usually encourages", he said, adding, "This step encourages visitors abroad to take money in cash as allowed by RBI."

He said, "I suggest the Finance Ministry rethink this and as suggested should decrease TCS to 5 per cent and issue some notification on how reimbursements can be taken adjusting TCS."

Earlier this week, RBI announced that it has decided to withdraw Rs 2000 denomination banknotes from circulation but they will continue to remain as legal tender.

It has advised banks to stop issuing Rs 2000 denomination banknotes with immediate effect.

Meanwhile, RBI said that citizens will continue to be able to deposit Rs 2000 banknotes into their bank accounts and/or exchange them into banknotes of other denominations at any bank branch up to September 30, 2023.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app